Financial terms can often seem confusing, like a new foreign language. Many entrepreneurs struggle to truly grasp in strategies that improve OCF (operating cash flow). This lack of understanding can hold your business back.

This guide strips away the jargon. We will make OCF clear, simple and easy to grasp. Understanding OCF empowers you to make smarter choices. You will learn what OCF is and why it matters. Finally, we’ll give you proven ways to make your cash flow healthier.

Analysing Your Operating Cash Flow: What the Numbers Mean

Knowing your OCF is just the start. You need to understand what it shows about your business. It reveals how healthy your company is.

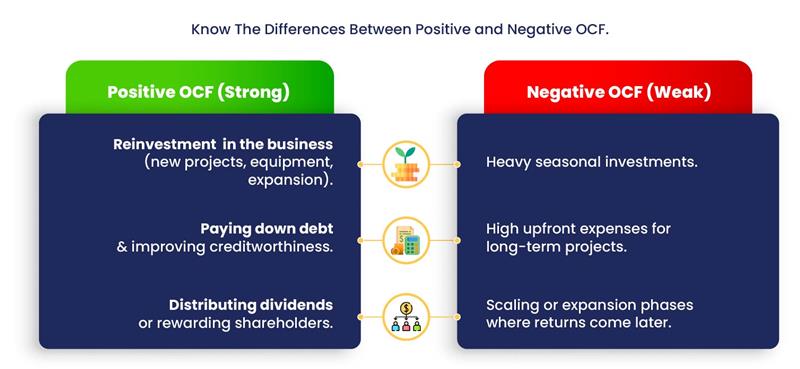

Interpreting Positive and Negative OCF

A positive OCF means your business generates more cash than it spends. This comes from its core operations. It signals a healthy, financially stable company. A strong positive OCF allows you to reinvest in the business. You can fund growth. You can pay down debt. It shows your business is a self-sustaining machine.

A negative OCF means your business is spending more cash than it brings in. This is a warning sign. Sustained negative OCF indicates your operations are not covering their costs. Your business might need to borrow money to stay afloat. Temporary negative OCF can sometimes be normal.

Key Ratios and Benchmarks for OCF

Looking at OCF on its own is useful. But when comparing it with other numbers gives more insight.

- Operating Cash Flow Margin: – This ratio tells you how much cash you generate per dollar of revenue.

- Formula: –Operating Cash Flow/ Total Revenue

- A high OCF margin measures efficient cash generation. Compare it with your industry average. Are you doing better or worse than the competitors? This helps you in gauging your operational effectiveness.

Refer More: How Payroll Can Integrate Your HR And Accounting System For Seamless Operations.

- Cash Flow Debt Ratio: – This predicts with how well your business pay off its debts using its own cash.

- Formula: Operating Cash Flow / Total Debt

- A higher ratio means the business is better positioned and it can service for its debt obligations. This is a key metric for lenders.

- Cash Flow Adequacy: – Can your OCF cover your essential cash needs? This includes capital spending. This money includes for new equipment and buildings. If your business pays for dividends too can OCF cover that too? Adequate OCF stands where you can grow and reward shareholders without external funding.

Learn more: Cash Flow and Its Calculation.

Strategies to Improve Your Operating Cash Flow

Making more cash available is a powerful goal. Here are actionable strategies to boost your operating cash flow.

Optimize Inventory Management

Too much inventory ties up cash. It also costs money to store. Efficient inventory is key.

- Just-In-Time (JIT): Adopt a JIT approach. Get materials and produce goods only when needed, cutting down on carrying costs. It frees up valuable cash.

- Inventory Turnover Ratio: Track how fast you sell your stock. A higher turnover means your cash is not sitting idle. Aim to improve this ratio.

- Actionable Tip: Conduct regular inventory audits by using demand forecasting tools. This minimises excess stock. You only buy what you need.

Accelerate Accounts Receivable Collection

Customers owing you money is common though slow collections hurt your OCF. Get your cash quicker.

- Clear Invoicing and Payment Terms: Make invoices easy to understand that clearly states payment deadlines. Provide multiple payment options.

- Early Payment Discounts: Consider offering a small discount for example, 2% off if paid within 10 days, thus encouraging faster payments.

- Follow-up Procedures: Have a consistent plan for overdue invoices and send polite reminders. Then follow up with calls.

- Actionable Tip: Use accounting software with automated reminders that frees up your time.

Read More : In Using Accounting System And Its Step-By-Step Process Which Makes Your Cash Flow Easier.

Extend Accounts Payable Wisely

Accounts payable is money you owe suppliers. Managing this smartly can help your OCF.

- Negotiate Favourable Terms: Talk to your suppliers if you can get longer payment terms. For example, 60 days instead of 30. Maintain good rapport with your customers.

- Avoid Late Fees: Always pay your invoices on time. And avoid late fees that drain your cash unnecessarily which bears as a bottle neck of your OCF.

- Actionable Tip: Only take early payment discounts from suppliers if it truly benefits you. Sometimes holding onto cash longer is more valuable.

Streamline Operating Expenses

Every dollar saved on operations directly boosts your OCF. Look for ways to cut costs without hurting quality.

- Cost Analysis: Review every single operating expense by watching out where is your money going and identify non-essential costs.

- Negotiate with Suppliers: Do not be afraid to renegotiating contracts and checking prices with service providers regularly. Always seek competitive rates.

- Actionable Tip: Explore bulk purchasing or join with other businesses for group discounts that can significantly reduce costs.

Transform Complex Cash Flow Into Clear Business Decisions With Our Advanced Accounting Software!

Final Thoughts- Mastering Your Cash Flow for Business Success

Operating cash flow is a true measure for the business stability and vitality. It’s more than just a number on a report. Learning the detailed version about cash flow operating in a business with its varied terms and calculations understands you with an actionable strategy in performing your business aesthetically.

Why wait? Seek with our experts and clear your doubts easily by calling us immediately!

FAQs

What does positive operating cash flow mean?

Positive operating cash flow refers to which business generates enough cash from operations to cover expenses and potentially reinvest in growth.

Can a company have profit but negative operating cash flow?

Yes. If most sales are on credit and receivables increase, profits may look good, but cash flow can be negative.

policy.

Which is better for financial analysis: OCF or net income?

OCF is considered more reliable than net income, since it reflects actual cash generation, not just accounting profits.

How often should businesses track OCF?

Ideally, businesses should monitor OCF monthly or quarterly for accurate financial health checkup. But it depends on each management policies too. With our effective accounting software, you can get various analytics of your business cashflow and make your business easy.