Ever wondered about knowing more about IR56B forms and their essentials? Let us learn about them in detail. Hong Kong’s Inland Revenue Ordinance (IRO) is significant to the city’s financial setup of any business. Obviously, there are two types of people in Hong Kong: those who pay taxes early and those who pay before the deadline. Understanding its rules is key for both every employer and employee. The IR56B notification is a critical yearly task for employers where it discloses to the Inland Revenue Department (IRD) what they paid their staff.

Missing these IR56B guidelines can bring penalties. This shows how important it is to send accurate information on time. This guide will look closely at the IR56B rules. We will make its purpose clear. We will see who it affects, what details it needs, and how to send it within the timeline.

Understanding the IR56B Notification

What is an IR56B Notification?

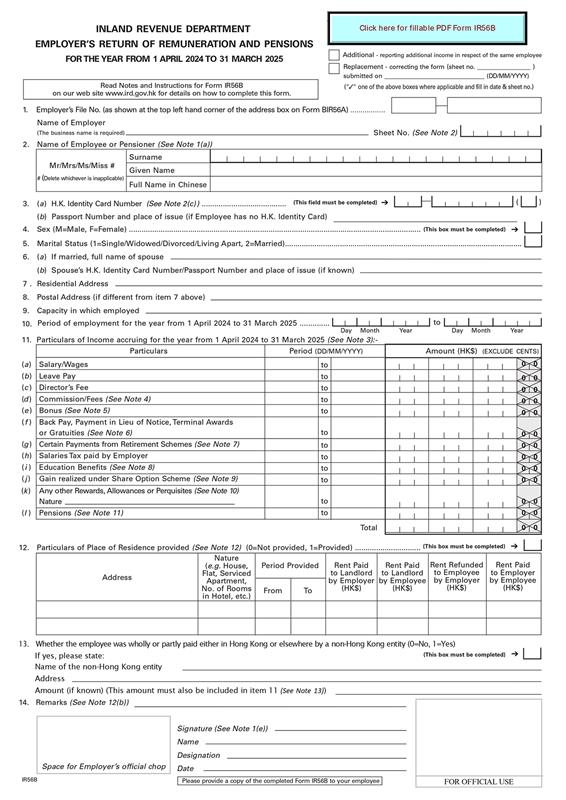

The IR56B form is an annual return of remuneration. Employers use it to report what they pay their employees each year. Think of it as a summary of earnings for tax purposes. With this form it helps the IRD to assess the correct tax for your staff which is a key part of managing employee tax in Hong Kong.

Legal Basis and Purpose

This reporting duty comes from the Inland Revenue Ordinance (Cap. 112) that is mandatory for employers. The IR56B helps the IRD know about employee earnings. This way, they can collect taxes fairly and efficiently. It ensures everyone pays their part, as the law intends.

Key Deadlines and Submission Periods

Usually, you send the IR56B each year with the reporting period for the year ending on 31st March. Employers typically get from April 1st to May 31st to send in these forms. What if an employee leaves your company in the middle of a tax year? You might need to submit an IR56B (or an IR56F) within a shorter timeframe.

Failure to meet this timeframe can result in penalties, including fines of up to HK$10,000.

If an employer fails to file the tax return, then he/she can be charged with extra penalties by the IRD. Depending on the severity of the offence, the Inland Revenue Commissioner can:

- The company may pay additional tax as a penalty,

- They may pay a fine,

- The person authorised to complete the tax return forms may be imprisoned.

In this form, it includes salaries, benefits, and pensions paid during the assessment year, which runs from April 1 to March 31. IR56B submissions must be done every year, and the IRD calculates the taxes every year based on the previous year of salary earned, from the previous year of April 1st to the current year of March 31st.

(Example: If you are filing for April 2025, you are filing based on payroll records from 1st April 2024 to 31st March 2025.)

Facts Employers And Employees Must Know: Who Needs To Submit An IR56B?

Employer Obligations

• The duty to submit an IR56B lies with all kinds of employers.

• Applies to all types of businesses in Hong Kong.

• Covers corporations, partnerships, and sole proprietorships.

• If you employ staff, you are required to submit the IR56B.

• Employers must also ensure their business registration is up to date and licensed.

Employee Eligibility for IR56B Reporting

• Employers must report employees who earn HKD 30,000 or more in the last year.

• The total remuneration includes salary and any other payments (if any variables).

• If an employee ceased employment in Hong Kong during the current year, their earnings must also be reported.

This ensures that all income is properly recorded for tax purposes.

Check Out More About: Types Of IR56 Forms Beneficial For Employers In Hong Kong.

Information Required for IR56B Submission

Personal Details of the Employee

You must provide full personal details for each employee. This includes their full name and their Hong Kong Identity Card (HKID) number. You will also need their home address and current marital status. Getting this right is the first step to accurate reporting.

Remuneration Details

Here is where you list all the money and benefits an employee received. Think beyond just salary or wages. Include bonuses, commissions, and any allowances. Housing allowances, transport benefits, and school fees are all part of it. Are you confused about benefits in kind, like company cars or share options? These also count and must be reported. You need to show what is taxable and what might not be, clearly and plainly.

Employer Information

Your company details are just as important. Provide your business name and full address. Also, your Business Registration Number (BRN) is essential. Additionally, including current contact information helps the IRD link the forms to your business correctly.

Prior Year Earnings and Deductions (if applicable)

Sometimes, you might need to mention previous tax years. This mostly happens for things like deferred payments. Are there specific deductions you need to report? The form lets you show these if they apply. Always double-check if any such details are needed for your submission.

The IR56B Submission Process

Methods of Submission

You have a few ways to send in your IR56B forms. Many employers use the e-Submission portal online. You can also send paper forms by post. Or you can deliver them by hand to the IRD office. The e-Submission method is often quicker and helps avoid common errors.

Using the IRD’s e-Submission System

Opting for online submission can save you time. First, you will need to register for an IRD account. Most businesses create an XML data file from their payroll system. This file contains all your employee details. You then upload this file through the e-Submission portal. The system checks your data, helping you spot any mistakes right away.

Accuracy and Verification

It is critical to check everything before clicking the submit button. Are the names spelt correctly and the HKID numbers right? Are all earnings noted down? Small mistakes can cause big problems later. Take the time to verify every bit of information.

Record Keeping Requirements

Once you submit your IR56B forms, keep copies. You should also keep all supporting documents, including payroll records, employment contracts, and benefit statements. The IRD asks you to keep these original records for at least seven years, proving your submissions were correct if they ever ask questions.

Penalties for Non-Compliance and Best Practices

Penalties for Late or Incorrect Submission

Failing to meet the IR56B deadline can be troublesome. The IRD takes late or incorrect submissions seriously. You could face fines or even prosecution. Submitting false information or not sending a form at all brings penalties under the Inland Revenue Ordinance. It is best to avoid these issues by being prompt and accurate.

Best Practices for Streamlined Compliance

Want to make IR56B submissions easy? Check out the top options:

• Ensure accurate employee records are up-to-date.

• Use reliable payroll software that can create IR56B data files.

• Start preparing IR56B submissions well before the May deadline.

• Stay informed about updates in IRD guidelines or changes.

• Do not hesitate to ask for professional advice if you are unsure.

Seeking Professional Assistance

Sometimes, tax matters are complex. If your company has tricky cases or many employees, consider getting help. Consulting experts like tax professionals and accountants ensures your IR56B compliance is spot on by following the right rules and best practices while avoiding penalties.

Refer More: Filing Profit Tax Returns In Hong Kong.

Final Thoughts – Stay Ahead of Compliance With Instant Tax Alerts

The IR56B notification is a crucial annual reporting task for Hong Kong employers. Following these rules keeps you compliant and helps you avoid penalties too. And it keeps Hong Kong’s tax system working smoothly.

By knowing your duties, what info you need, and how to submit, you can handle this requirement well. Good record-keeping and accuracy are vital. They make sure your IR56B submission is easy and correct every time.

The Roadmap To Pick Advanced And Best Payroll Software!

Planning to switch your calculations to make it easier with our Automated Payroll Software? Seek our experts for better clarification. Talk to us today!